Imagine having a superpower in your wallet that can transform the way you shop, travel, and manage your finances. The ultimate credit card isn't just a piece of plastic; it's your gateway to exclusive benefits, cashback, rewards, and financial freedom. If you're searching for the ultimate credit card, you've come to the right place. This article will dive deep into what makes a credit card truly "ultimate" and how it can revolutionize your financial life.

Let’s face it, in today’s world, credit cards aren’t just tools for transactions—they’re your best financial allies. Whether you're booking flights, splurging on luxury items, or simply paying your bills, the ultimate credit card has become a must-have for anyone looking to maximize their money. But with so many options out there, how do you find the one that truly fits your needs? That’s exactly what we’re going to explore today.

From cashback rewards to travel perks, the ultimate credit card is more than just a payment method. It’s your ticket to a smarter, more rewarding financial lifestyle. So grab a cup of coffee, sit back, and let’s uncover what makes a credit card truly "ultimate." By the end of this article, you’ll know exactly what to look for and how to make the most out of your credit card game.

- Goran Viscaronnji263 The Talented Actor Who Stole Hearts On Er And Beyond

- Tamron Halls Husband A Closer Look Into The Man Behind The Iconic Host

What Makes a Credit Card "Ultimate"?

Let’s break it down. When we talk about the ultimate credit card, we’re not just throwing around buzzwords. An ultimate credit card is one that offers a combination of features that cater to your lifestyle, spending habits, and financial goals. But what exactly does that mean? Here’s the lowdown:

- High cashback rewards on everyday purchases

- Generous travel perks, like free checked bags and lounge access

- No annual fees or waived fees for high spenders

- Low interest rates or 0% introductory APR

- Top-notch customer service and fraud protection

When you’re shopping for the ultimate credit card, these are the things you need to keep an eye on. It’s not just about flashy rewards; it’s about finding a card that aligns with your life and helps you save more while spending smarter.

Understanding the Benefits of the Ultimate Credit Card

So, why should you care about the ultimate credit card? Well, because it can make your life easier, richer, and more rewarding. Here’s how:

- My Chart Uihc The Ultimate Guide To Understanding And Maximizing Your Healthcare Experience

- Nc Skip The Games The Ultimate Guide To Leveling Up Your Dating Game

1. Cashback Rewards That Boost Your Budget

Who doesn’t love getting money back for doing what you already do? The ultimate credit card offers cashback rewards on everything from groceries to gas. Some cards even offer up to 6% cashback on certain categories, which can add up quickly. Think about it—if you spend $1,000 a month on groceries and gas, you could earn $60 back just by using the right card.

2. Travel Perks That Take You Places

Traveling is one of life’s greatest joys, and the ultimate credit card can make it even better. With perks like free checked bags, airport lounge access, and travel credits, you can save hundreds on your next trip. Some cards even offer trip cancellation insurance and travel accident protection, giving you peace of mind while you’re on the go.

3. Financial Security That Keeps You Safe

No one likes dealing with fraud or theft, but the ultimate credit card has your back. Most top-tier cards come with advanced fraud detection, purchase protection, and 24/7 customer support. If something goes wrong, you can rest easy knowing that your card issuer is there to help.

How to Choose the Right Ultimate Credit Card

With so many options on the market, choosing the right ultimate credit card can feel overwhelming. But don’t worry—we’ve got you covered. Here’s a step-by-step guide to finding the perfect card for you:

Step 1: Evaluate Your Spending Habits

Before you apply for any card, take a close look at where you spend the most money. Are you a frequent traveler? Do you shop online a lot? Do you spend a lot on dining out? The ultimate credit card should align with your spending patterns to maximize your rewards.

Step 2: Check the Rewards Program

Not all rewards programs are created equal. Some cards offer cashback, while others offer points or miles. Make sure you understand how the rewards work and what you can redeem them for. For example, if you travel a lot, a card with a strong miles program might be the way to go.

Step 3: Consider the Fees

While many ultimate credit cards come with annual fees, some offer fee waivers or credits that offset the cost. Make sure you calculate whether the benefits outweigh the fees. For example, if a card charges a $500 annual fee but offers $700 in travel credits, it might still be worth it.

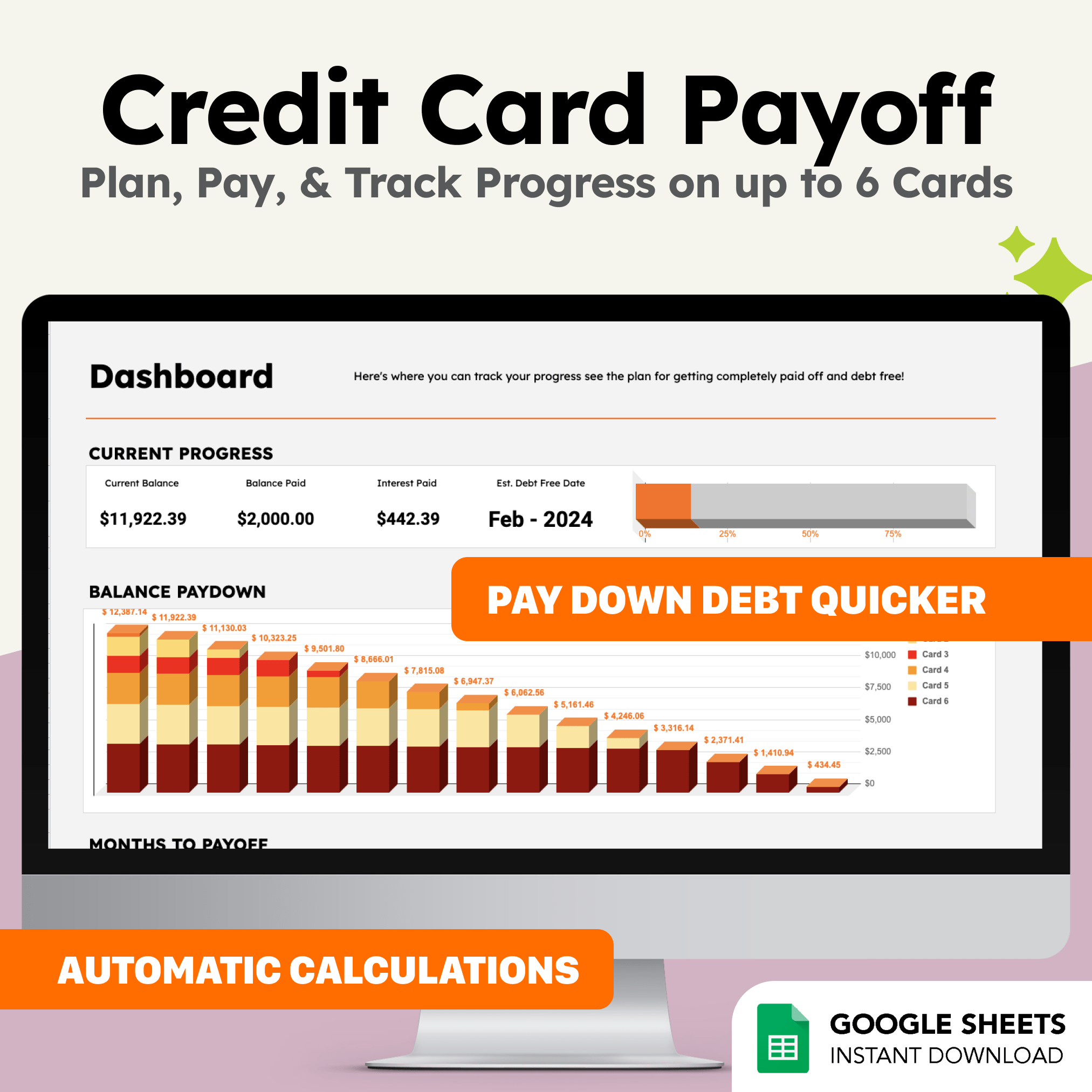

Step 4: Look at the Interest Rates

Even the ultimate credit card isn’t perfect if it comes with sky-high interest rates. If you carry a balance, make sure the card offers a competitive APR. Some cards even offer 0% introductory APR for the first year, which can save you a ton of money.

Top Picks for the Ultimate Credit Card

Now that you know what to look for, let’s talk about some of the best ultimate credit cards on the market. These cards have been vetted for their rewards, perks, and overall value. Check them out:

1. The Ultimate Travel Card

This card is a dream for frequent flyers. With unlimited miles on flights, free checked bags, and access to over 1,000 airport lounges worldwide, it’s the ultimate companion for globetrotters. Plus, you’ll earn 3 miles per dollar spent on travel and dining.

2. The Ultimate Cashback Card

If you’re more into cash than miles, this card is for you. It offers up to 5% cashback on groceries, gas, and online shopping, with no limit on how much you can earn. Plus, there’s no annual fee, making it one of the most accessible ultimate credit cards out there.

3. The Ultimate Premium Card

For those who want it all, this card offers a luxurious experience. With a $500 annual travel credit, access to exclusive events, and concierge services, it’s the ultimate card for high rollers. Sure, it comes with a hefty annual fee, but the benefits make it worth it for frequent travelers and big spenders.

How to Maximize Your Ultimate Credit Card

Having the ultimate credit card is one thing, but knowing how to use it is another. Here are some tips to help you get the most out of your card:

1. Pay Your Balance in Full

One of the best ways to maximize your ultimate credit card is to pay your balance in full every month. This ensures you avoid interest charges and get the most out of your rewards.

2. Use Your Card for Big Purchases

Whether you’re buying a new TV or booking a vacation, use your ultimate credit card for big-ticket items. Not only do you earn more rewards, but you also get purchase protection and extended warranties.

3. Take Advantage of Sign-Up Bonuses

Many ultimate credit cards offer sign-up bonuses that can be worth hundreds or even thousands of dollars. Make sure you meet the spending requirements to unlock these bonuses and start earning right away.

Common Misconceptions About Ultimate Credit Cards

There’s a lot of misinformation out there about ultimate credit cards. Let’s clear up some of the most common myths:

Myth 1: Ultimate Credit Cards Are Only for Rich People

Not true! While some ultimate credit cards come with annual fees, many offer fee waivers or benefits that make them accessible to everyone. Plus, with cashback and rewards, you can save money no matter your income level.

Myth 2: You’ll Always Get Hit With Interest Charges

Wrong again! If you pay your balance in full every month, you won’t incur any interest charges. Many ultimate credit cards also offer 0% introductory APR, giving you time to pay off big purchases without accruing interest.

Myth 3: Ultimate Credit Cards Are Too Complicated

Not at all! While ultimate credit cards may have more features than basic cards, they’re designed to be user-friendly. Most come with mobile apps and customer support to help you navigate the rewards system.

Conclusion: Time to Upgrade Your Credit Card Game

There you have it—the ultimate guide to the ultimate credit card. Whether you’re a travel enthusiast, a cashback lover, or a premium spender, there’s an ultimate credit card out there for you. By understanding your needs, evaluating your options, and maximizing your rewards, you can unlock the full potential of your credit card.

So what are you waiting for? Take the first step toward financial freedom today. Apply for your ultimate credit card, and start enjoying the benefits. And don’t forget to share this article with your friends and family—because everyone deserves to have the ultimate credit card in their wallet.

Table of Contents

- What Makes a Credit Card "Ultimate"?

- Understanding the Benefits of the Ultimate Credit Card

- How to Choose the Right Ultimate Credit Card

- Top Picks for the Ultimate Credit Card

- How to Maximize Your Ultimate Credit Card

- Common Misconceptions About Ultimate Credit Cards

- Conclusion

Detail Author:

- Name : Willis Wolf

- Username : aurelia18

- Email : lea87@walker.net

- Birthdate : 1988-07-21

- Address : 82117 Kassandra Shores Apt. 701 Stefanieburgh, MI 67999-1537

- Phone : +1-716-779-8347

- Company : Hoppe-Howe

- Job : Flight Attendant

- Bio : Aperiam omnis sunt dolorum et. Rerum nobis distinctio culpa et nemo et vitae dolores. Quae aut perferendis distinctio exercitationem perspiciatis consequuntur.

Socials

linkedin:

- url : https://linkedin.com/in/tremaine_id

- username : tremaine_id

- bio : Dicta corrupti commodi non officia.

- followers : 5450

- following : 2749

instagram:

- url : https://instagram.com/tremaine_ernser

- username : tremaine_ernser

- bio : Molestiae est nostrum eligendi velit. Et qui id asperiores vitae. Itaque a totam et delectus.

- followers : 2239

- following : 324

facebook:

- url : https://facebook.com/tremaine_ernser

- username : tremaine_ernser

- bio : Eum eius error nihil voluptate ea. Magni facilis nisi voluptatem est.

- followers : 791

- following : 310

tiktok:

- url : https://tiktok.com/@tremaine_ernser

- username : tremaine_ernser

- bio : Deserunt mollitia molestiae incidunt cupiditate.

- followers : 6271

- following : 480